Welcome to VelSicuro.com | Cybersecurity Solutions

- hub@velsicuro.co.id

- HEAD OFFICE JHONTAX TB SIMATUPANG, GEDUNG

- Home

- Article

Get to know the latest types of deepfakes specifically designed to drain your account balance.

Get to know the latest types of deepfakes specifically designed to drain your account balance.

The banking sector is highly vulnerable to cyberattacks because it manages large amounts of sensitive data and relies heavily on digital technology. With the increasing proliferation of digital transactions, AI-based cybercrime is also on the rise and becoming more difficult to detect.

A Real-Life Deepfake Example

“An employee received a video call from their boss instructing a large fund transfer. The boss's face and voice appeared authentic, but it turned out to be a deepfake manipulation. The funds vanished, and an investigation confirmed that the boss had never made the call.”

Ganda Raharja Rusli, Director of Risk, Compliance, and Legal at Allo Bank, asserts that such stories are no longer fiction but a real threat to the global banking industry, including Indonesia.

Two Primary Types of Deepfake Threats

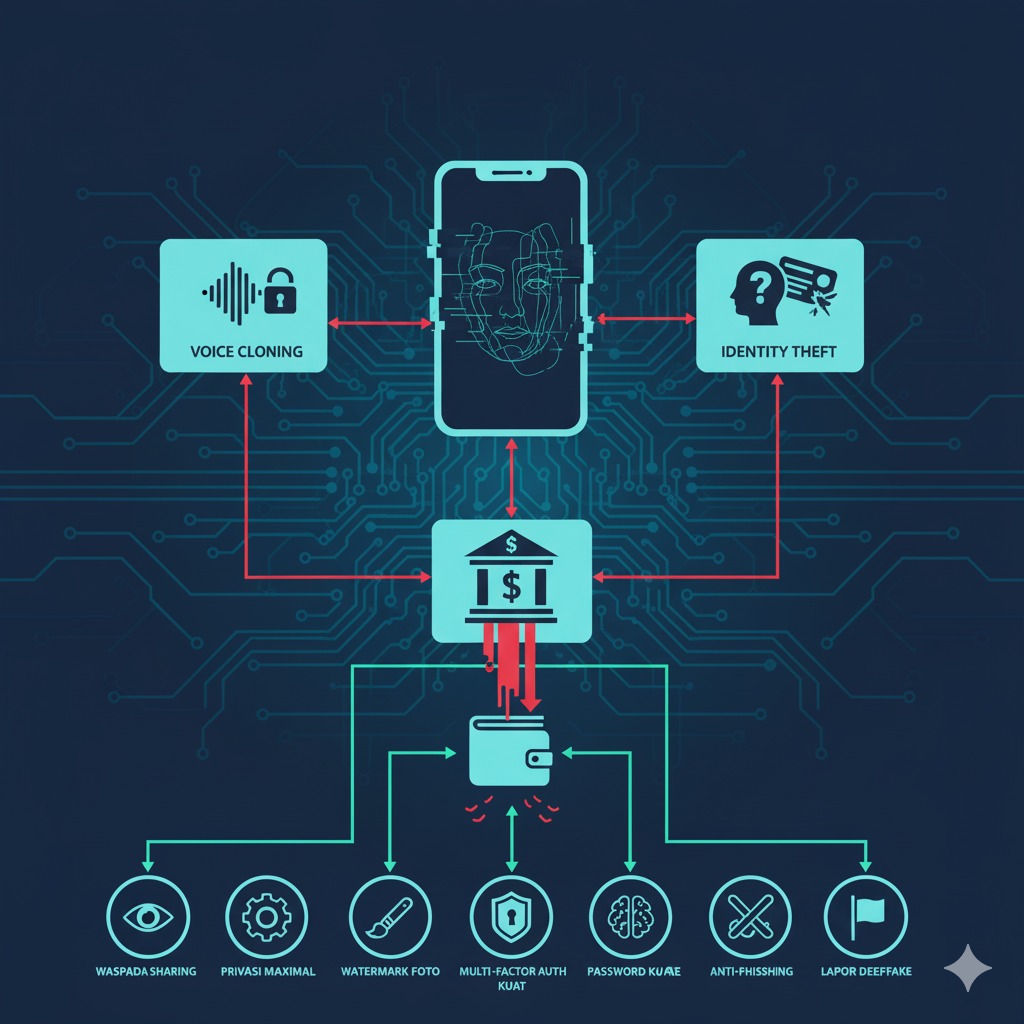

Currently, at least two main types of deepfakes threaten banks:

- Voice Cloning Scam: Cybercriminals use sophisticated technology to imitate a person's voice with high accuracy. For example, they mimic a company leader's voice to instruct subordinates to make a fund transfer, and due to the resemblance, the subordinate complies, and the funds are stolen.

- Identity Theft & Synthetic KYC (Know Your Customer): This method involves the complete theft of a customer's identity, which can even be rendered in a video call with highly realistic face and voice. Deepfakes, which were once only seen as harmless fun (such as parodies of world leaders), are now being used by cybercriminals.

Necessary Protection Strategies

Given the complexity of fraud and the rapid advancement of deepfake technology, Ganda Raharja Rusli emphasizes that digital banks must adopt balanced anticipatory measures. Banks need to implement a risk optimization strategy that can balance the customer experience with security aspects to maintain long-term satisfaction and loyalty.

Echoing this, Anggraini Rahayu from Advance.AI (a provider of AI-based security solutions) calls the rapid evolution of deepfake a serious threat to consumer trust in digital banking. A proactive security approach is crucial, not only to protect users from potential personal losses but also to safeguard the reputation of the financial institution itself.

Source:

https://cyberhub.id/tips-trik/foto-selfie-disalahgunakan-deepfake

https://csirt.or.id/berita/ancaman-baru-phantomcard-serang-bank

Popular article

-

06 March 2023

06 March 2023Comodo Security Solutions Rebrands to Xcitium

-

21 February 2023

21 February 2023Indihome Attacked by Hackers, Data of 26 Million Customers Leaked

-

-

04 November 2023

04 November 2023Bagaimana Cara Memilih Solusi EDR yang Tepat Untuk Bisnis Anda?

Categories

Tags

Need Any Technology Solution

Let’s Work Together on Project

Contact Information

- 087890908898

- hub@velsicuro.co.id

-

HEAD OFFICE JHONTAX TB SIMATUPANG,

GEDUNG 18 OFFICE PARK

Jl. TB Simatupang No.Kav. 18, 21th Floor, Kebagusan, Ps. Minggu, Kota Jakarta Selatan, Daerah Khusus Ibukota Jakarta 12520

© 2024 velsicuro.com. All Rights Reserved. Developed by SevenLight.ID